Offer Ends Nov 1st!

We’re offering 20% off ANY course or spreadsheet this month (including bundles)! Just use code “SAVE20SB” at checkout.

Our best course —> Complete DCF Course

Our best spreadsheet —> Automated Stock Analysis Spreadsheet (powered by Wisesheets)

P.S. Our last sale was in January!

🌾 Welcome to StableBread’s Newsletter!

Back in early 2022, I wrote an article describing how to identify an overvalued stock market, which covered the yield curve, S&P 500 P/E ratio, S&P 500 dividend yield, CAPE Ratio, Buffett Indicator, and other indicators.

But none of these indicators proved more powerful at predicting long-term equity returns than the P/E and CAPE ratios.

So after re-reading through Shiller's "Irrational Exuberance” (2016), and coming across Deutsche Bank's 2025 study examining 300 years of global market returns across 56 economies, I decided to put together this post that explains:

How the CAPE ratio works and why it smooths earnings over 10 years.

What the data reveals about return differences between cheap and expensive markets.

How dividend yields and portfolio backtests confirm the valuation pattern.

Where the US and global markets rank today by CAPE, P/E, and dividend yield metrics.

The Fed Model's failure and what the Excess CAPE Yield reveals about current market conditions.

By the end of this post, you'll see the evidence behind why cheap markets historically beat expensive ones, where US and global valuations stand today, and what the Excess CAPE Yield suggests about current market conditions.

📜 Robert J. Shiller: Sterling Professor of Economics at Yale University. Winner of the 2013 Nobel Memorial Prize in Economic Sciences for his empirical analysis of asset prices. Best known for developing the Case-Shiller Home Price Index and the CAPE ratio featured in his book "Irrational Exuberance."

CAPE Ratio Explained

Standard price-to-earnings (P/E) ratios use trailing twelve-month earnings in the denominator.

This creates a problem as earnings collapse during recessions, causing P/E ratios to spike to absurdly high levels that don't reflect expensive markets (the opposite occurs during booms, when surging earnings push P/E ratios artificially low).

Benjamin Graham and David Dodd proposed using average earnings instead of current earnings in their 1934 classic "Security Analysis."

Shiller formalized this into the CAPE ratio, adding the inflation adjustment to create a consistent measure across different inflationary environments:

CAPE Ratio = Real Stock Price Index / 10-Year Moving Average of Real Earnings

where:

Real Stock Price Index = Current inflation-adjusted stock price

10-Year Moving Average of Real Earnings = Average of past 10 years of inflation-adjusted earnings (to smooth out temporary earnings distortions)

You don't need to derive this yourself. Shiller maintains regularly updated CAPE data on his website for anyone to access.

Historical CAPE Ratio Evidence

Deutsche Bank's 2025 analysis examined 56 economies with data extending back as far as 300 years, grouping returns by starting valuation levels. The most powerful predictors of long-term equity performance were the P/E and CAPE ratios measured at the start of the investment period.

Over 25-year horizons, the pattern was unmistakable. Markets purchased at low valuations consistently delivered strong returns, while markets bought at high valuations produced weak returns:

Source: Deutsche Bank (2025)

The cheapest markets by CAPE (below 8x) delivered ~10% annual returns over the subsequent 25 years. The most expensive markets (above 20x CAPE) generated barely 4% annually (return differential of 6% per year).

The same relationship held over shorter five-year horizons:

Source: Deutsche Bank (2025)

Cheap markets delivered ~10-12% annual returns over five years, while expensive markets produced near-zero or slightly negative returns. Starting valuations predicted performance consistently across both timeframes.

Dividend Yields Confirm the Pattern

P/E and CAPE data only became broadly available for many countries starting in the 1960s. Prior to that, such data existed for just a small number of markets.

But dividend yield data extends much further back, with 31 economies providing over a century of history.

The same valuation pattern emerged with dividend yields across both 25-year and 5-year horizons:

Source: Deutsche Bank (2025)

Markets starting with low dividend yields (0-1%) delivered ~4% over 25 years and ~2-4% over 5 years. Markets starting with high dividend yields (above 8%) generated ~7% over 25 years and exceeded 12% over 5 years.

Higher starting dividend yields consistently predicted better long-term performance, confirming what P/E and CAPE ratios demonstrated.

Testing the Strategy

Deutsche Bank then tested whether starting valuations could identify which markets would outperform by creating portfolios split between economies with high and low valuations, rebalanced annually:

Source: Deutsche Bank (2025)

Portfolios tilted toward markets with low starting valuations consistently delivered stronger equity returns than portfolios tilted toward expensive markets.

The outperformance was greatest using P/E ratios (8.8% annual advantage), followed by CAPE ratios (5.1%) and dividend yields (3.5%).

This simple approach of favoring cheaper markets over expensive ones produced meaningful long-term outperformance regardless of which valuation metric was used.

US Market in Historical Context

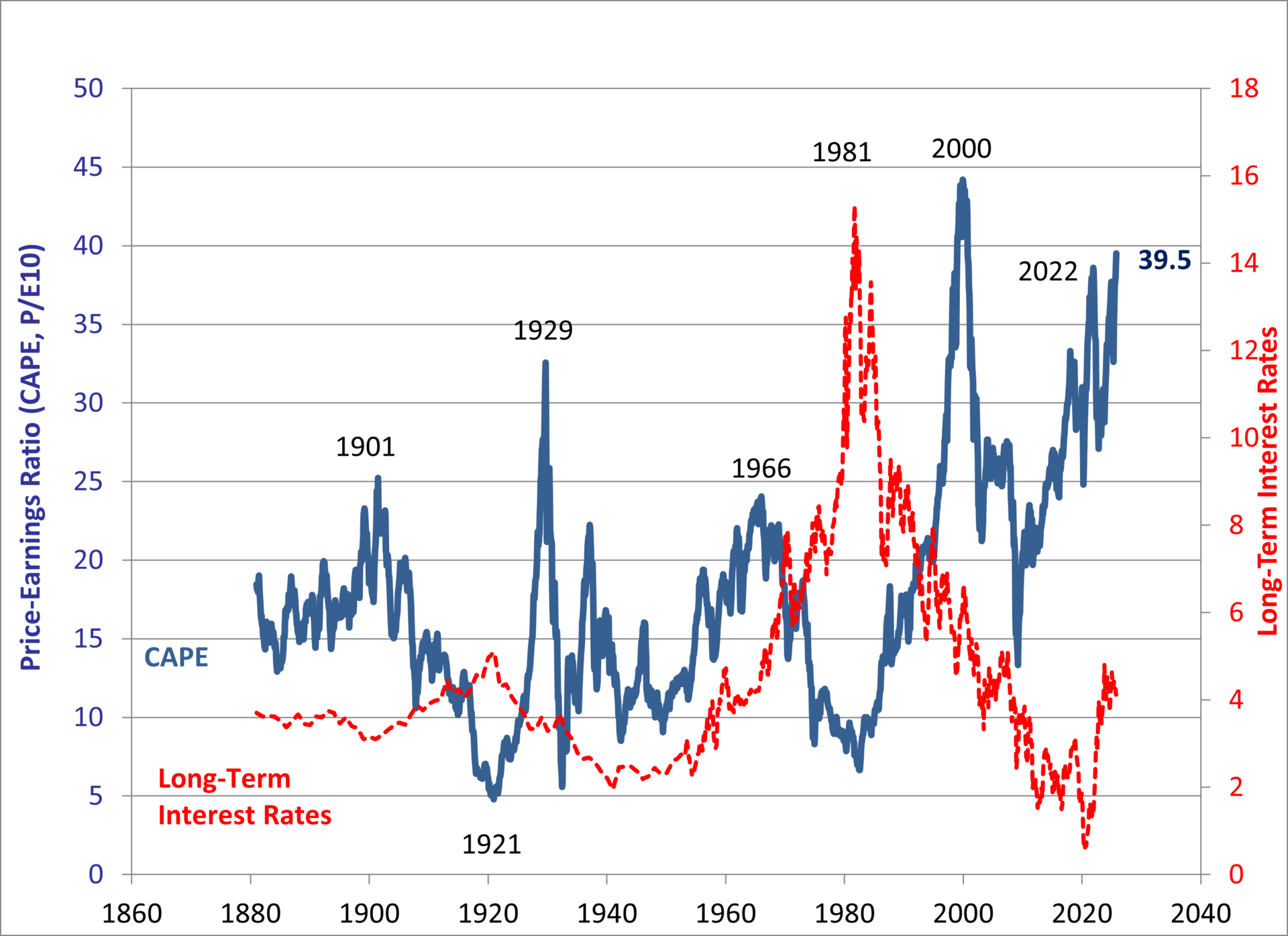

As you can observe from the chart below, there were four major CAPE peaks (1901, 1929, 1966, and 2000), with the current CAPE at 39.9:

Each peak was followed by weak or negative returns. The only time CAPE exceeded current levels was during the buildup to the dot-com bubble in 2000. The 10-year real returns following that period were negative.

The relationship between starting CAPE levels and subsequent 10-year returns becomes clear when plotted across the past century:

Source: Deutsche Bank (2025)

The downward slope is unmistakable:

Years with low CAPEs (1920, 1949, 1982) were followed by strong long-term returns.

Years with high CAPEs (1929, 1937, 1966, 1997-2000) were followed by weak or negative returns.

Some exceptions exist. January 1899 delivered 5.5% annual returns over the following decade despite a CAPE of 22.9. January 1922 delivered only 8.7% annual returns despite a low CAPE of 7.4. But these outliers don't negate the broader pattern.

The subsequent 25 years since 2000 proved this pattern again. US equities experienced several powerful multi-year rallies, yet their overall returns lagged earlier decades significantly.

Where Markets Stand Today

Deutsche Bank also ranked global equity markets by their current P/E and CAPE ratios:

Source: Deutsche Bank (2025)

The US ranked among the most expensive markets globally by both P/E and CAPE ratios. Multiple emerging markets and developed economies traded at significantly lower valuations.

Notably, US dividend yields ranked among the lowest globally, while dozens of other markets offered substantially higher yields:

Source: Deutsche Bank (2025)

US yields rank lowest partly because share buybacks have increasingly replaced dividends as the primary method of returning capital to shareholders over the past two decades.

Fed Model & Excess CAPE Yield

Fed Model

The "Fed Model" suggests that stock valuations should move inversely with interest rates. When rates fall, stocks should become more expensive relative to earnings:

Source: Robert Shiller

During the mid-1960s through early 1980s, interest rates rose while the P/E ratio declined. From the early 1980s through the late 1990s, interest rates fell and stock prices rose. This relationship was used constantly during the late 1990s to justify high stock valuations.

But the evidence for the Fed Model is weak. From 1881 to 2014 (based on Shiller’s book), no strong relationship exists between interest rates and the P/E ratio. Even during the Great Depression, interest rates were unusually low, which by the Fed Model logic should have pushed stocks very high relative to earnings (which didn’t happen).

Interest rates continued decreasing after the market peaked in 2000, yet we saw the opposite of the Fed Model's predictions. Both the P/E ratio and interest rates declined together. After this occurred, references to the Fed Model largely disappeared from market commentary.

The current environment features high valuations (CAPE of 39.9) and low interest rates (~4%), with rates expected to decline further. This combination means investors face unattractive prospective returns in both stocks and bonds rather than just one asset class.

Bond returns follow their own clear pattern based on starting interest rate levels:

Source: Deutsche Bank (2025)

Median 25-year real bond returns hovered near zero when nominal policy rates started below 4%. Returns only became meaningfully positive once policy rates moved above that threshold. Major central bank policy rates currently range from 2-4% and are expected to decline.

Excess CAPE Yield

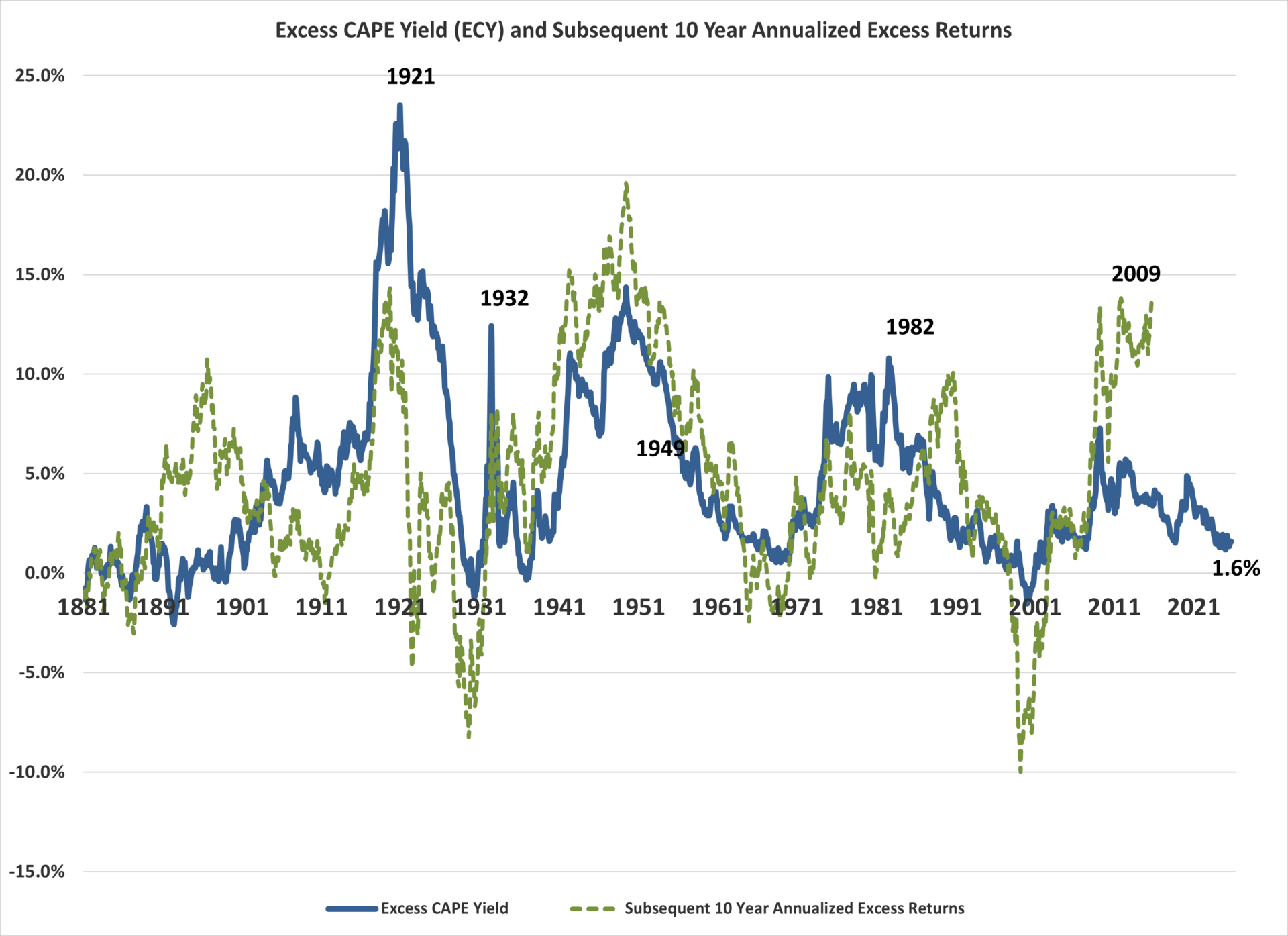

The excess CAPE yield provides one final perspective on current market conditions:

Source: Robert Shiller

Excess CAPE Yield = (1 / CAPE Ratio) - Long-Term Interest Rate

This represents the earnings yield premium over bonds:

High excess yields (1921, 1932, 1949, 1982, 2009) predicted strong subsequent returns.

Low or negative excess yields (1929, 1966, 1999-2000) predicted poor returns.

Currently, the excess CAPE yield stands at just 1.6%, among the lowest readings in 140 years outside of the major market peaks that preceded extended periods of weak returns.

Thanks for Reading!

StableBread Resources

Stock Research Platform: Fiscal.ai offers the most complete all-in-one research terminal we’ve found that’s accessible to the average retail investor (use code “STABLEBREAD” to save 15%).

Stock Analysis Checklist: This 50-question stock analysis checklist (direct download link) will help guide your stock research.

Spreadsheets: Login to the customer dashboard (with your email) to access 60+ Excel models.

Articles: Read 100+ in-depth guides on stock analysis, stock valuation, and portfolio management.

Newsletter Posts: Browse 40+ newsletter posts, where we share specific teachings from successful value investors.

Investors: Visual and list of 50+ investors who beat the S&P 500 Total Return Index over an extended period of time.

Calculators: Accelerate the stock analysis and valuation process with 150+ web-based calculators.