In Partnership With Fiscal.ai and Wisesheets

For stock research and screening, we use Fiscal.ai (use code “STABLEBREAD” to save 15%). It’s the most complete all-in-one research terminal we’ve found that’s accessible to the average retail investor.

For custom analysis and flexible valuation models, we use our Automated Stock Analysis Spreadsheet, powered by Wisesheets (the best spreadsheet add-on for stock data).

These are the two tools we use to analyze and value stocks more effectively and reach quicker, more informed investment decisions. Both have free versions if you want to try them out.

🌾 Welcome to StableBread’s Newsletter!

Novice investors may attribute pricing power, what Warren Buffett calls "the single most important decision in evaluating a business," to a business that can raise the cost of its products/services every year, ideally keeping up with inflation.

But more seasoned investors recognize that businesses with real pricing power aren't those that simply raise prices in a steady, predictable line over time—that's the bare minimum. The best investable businesses offer products/services currently underpriced relative to the value they deliver to customers.

This is what Josh Tarasoff from Greenlea Lane Capital argues in his 2011 presentation at the VALUE x Vail conference. This post elaborates on Tarasoff's distinction between two types of pricing power and explains why the most valuable opportunities differ from what investors typically seek. We'll share two of our own real-world examples as well.

📜 Josh Tarasoff: General Partner of Greenlea Lane Capital Partners, LP. Graduated from Drake University in 2001. Worked at Goldman Sachs and holds an MBA from Columbia Business School.

Two Categories of Pricing Power

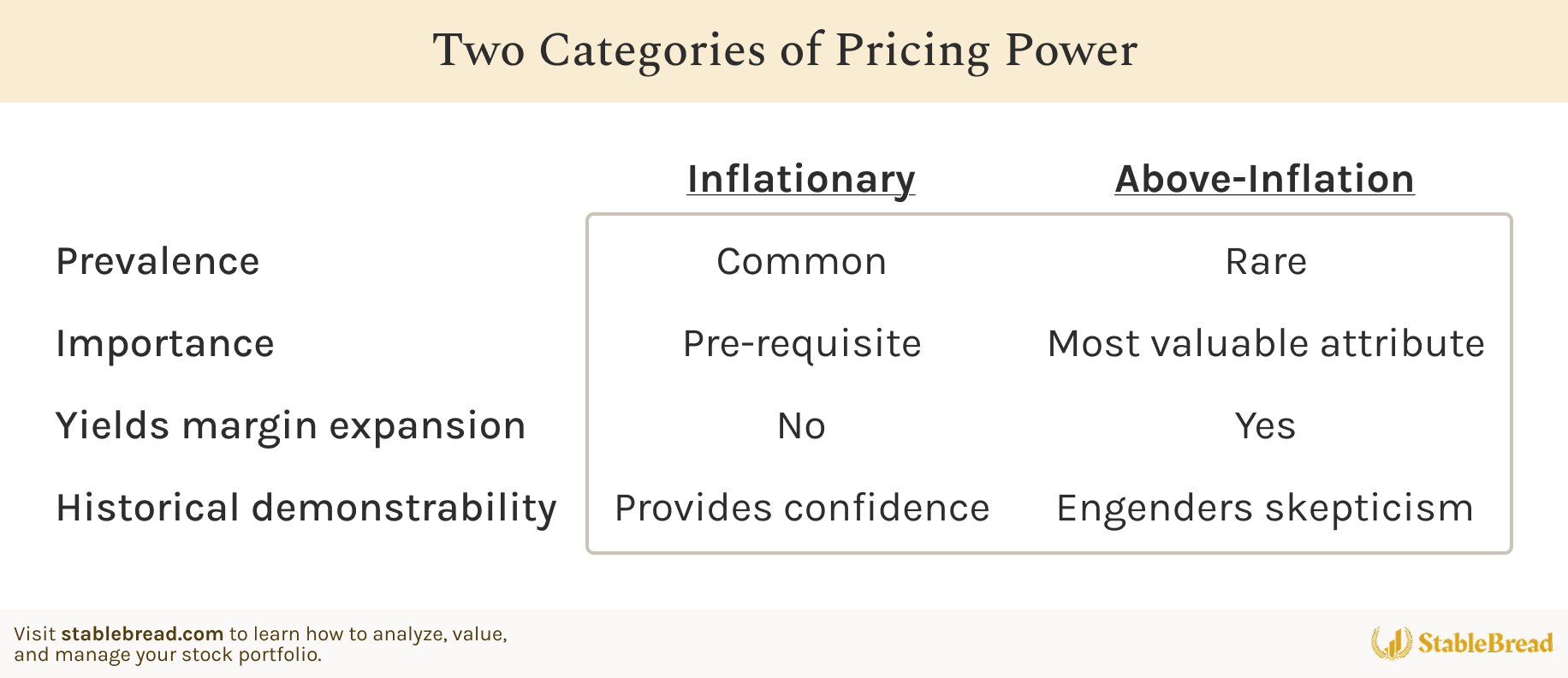

Tarasoff separates pricing power into two distinct categories with vastly different characteristics and investment implications:

Two Categories of Pricing Power | Recreated by StableBread

Inflationary Pricing Power

Inflationary pricing power represents the ability to pass along cost increases without losing customers. A company that raises prices 3% when inflation runs 3% maintains this type of pricing power.

This capability is certainly better than being unable to offset inflation, but Tarasoff argues it represents the minimum threshold for business quality rather than a competitive advantage worth paying up for.

As a business owner, you’d expect your income to at least maintain purchasing power over time. Anything less suggests you should probably sell the business.

So inflationary pricing power, in reality, is common because inflation represents the general increase in price levels across the economy.

Above-Inflation Pricing Power

Above-inflationary pricing power means raising prices faster than inflation without hurting demand. Above-inflation pricing power is valuable because every dollar of above-inflation price increase flows straight to profit.

Consider a company with a 15% operating margin that can raise prices at inflation +1%. That extra 1% above inflation produces ~7% operating income growth (1% / 15%). This leverage makes above-inflation pricing power far more valuable than simply keeping pace with inflation.

The problem is that sustained above-inflation pricing power is rare. Tarasoff identifies two necessary conditions:

Favorable competitive dynamics: Brand strength, customer captivity, or rational competitive behavior create the possibility of pricing power.

Gap between price and value of product/service: Raising real prices (above inflation) cannot help demand unless the product was underpriced to begin with. Customers collectively must be willing to pay more in real terms for the same product.

The challenge is that above-inflation pricing power is finite (unlike inflationary pricing power).

Every product/service has a maximum price that customers will pay before demand suffers. Once a company exploits its latent pricing power by moving prices toward that ceiling, the opportunity disappears.

Don't just look for companies with a demonstrable history of pricing power. Instead, look for companies at/near the beginning of the finite period during which they can exploit their latent pricing power—before the market prices in the opportunity.

Real-World Examples

Let's look at two real-world examples of companies that demonstrate the finite nature of pricing power and the importance of timing.

Louis Vuitton

Louis Vuitton (LVMH) operates as the world's largest luxury goods conglomerate.

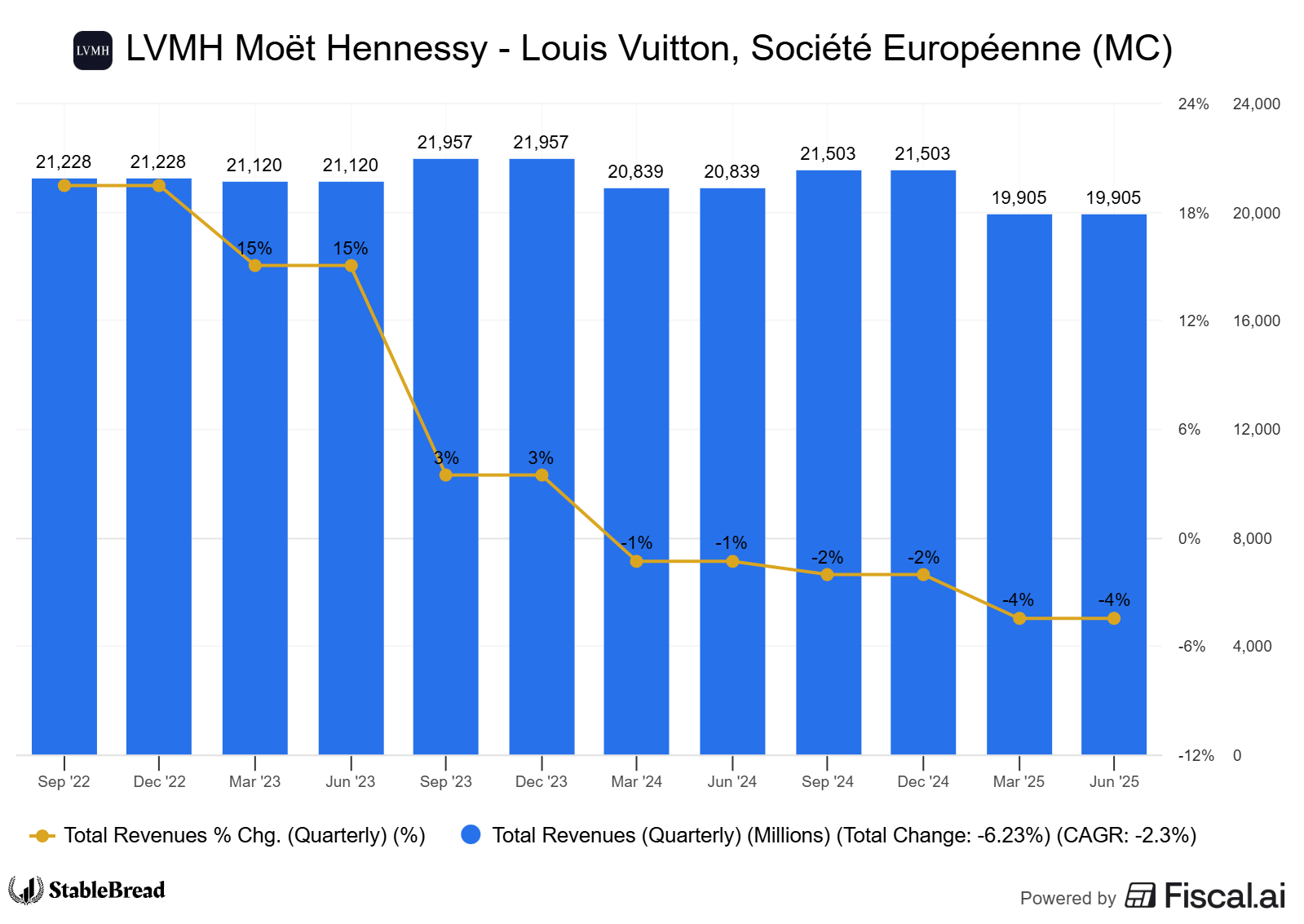

The company rode aggressive price increases to strong revenue growth, but that growth has now reversed, as the quarterly chart below demonstrates:

LVMH: Quarterly Revenue Growth

Multiple industry studies reveal how aggressively luxury brands pushed pricing over recent years:

Bernstein research: Luxury brands increased prices by an average of 36% between 2020 and 2023, with Louis Vuitton's prices rising 32%.

McKinsey's State of Luxury report: Price increases accounted for more than 80% of growth during the 2019-2023 period, while volume gains were more moderate.

Bain & Company's 2024 luxury report: The industry lost ~50 million customers between 2022 and 2024, as buyers either opted out or were priced out of the market.

LVMH’s Oct. 14, 2025 earnings call commentary also suggests pricing power exhaustion.

CFO Cécile Cabanis stated the “Fashion and Leather Goods” sequential improvement "was mostly made through improvement of traffic and volume. Price was not very different from Q2 and mix was around neutral." Management even admitted "in order to stabilize and grow the margin, they'll need to be backed to growth cycle," indicating they need to return to positive revenue growth to restore margin expansion.

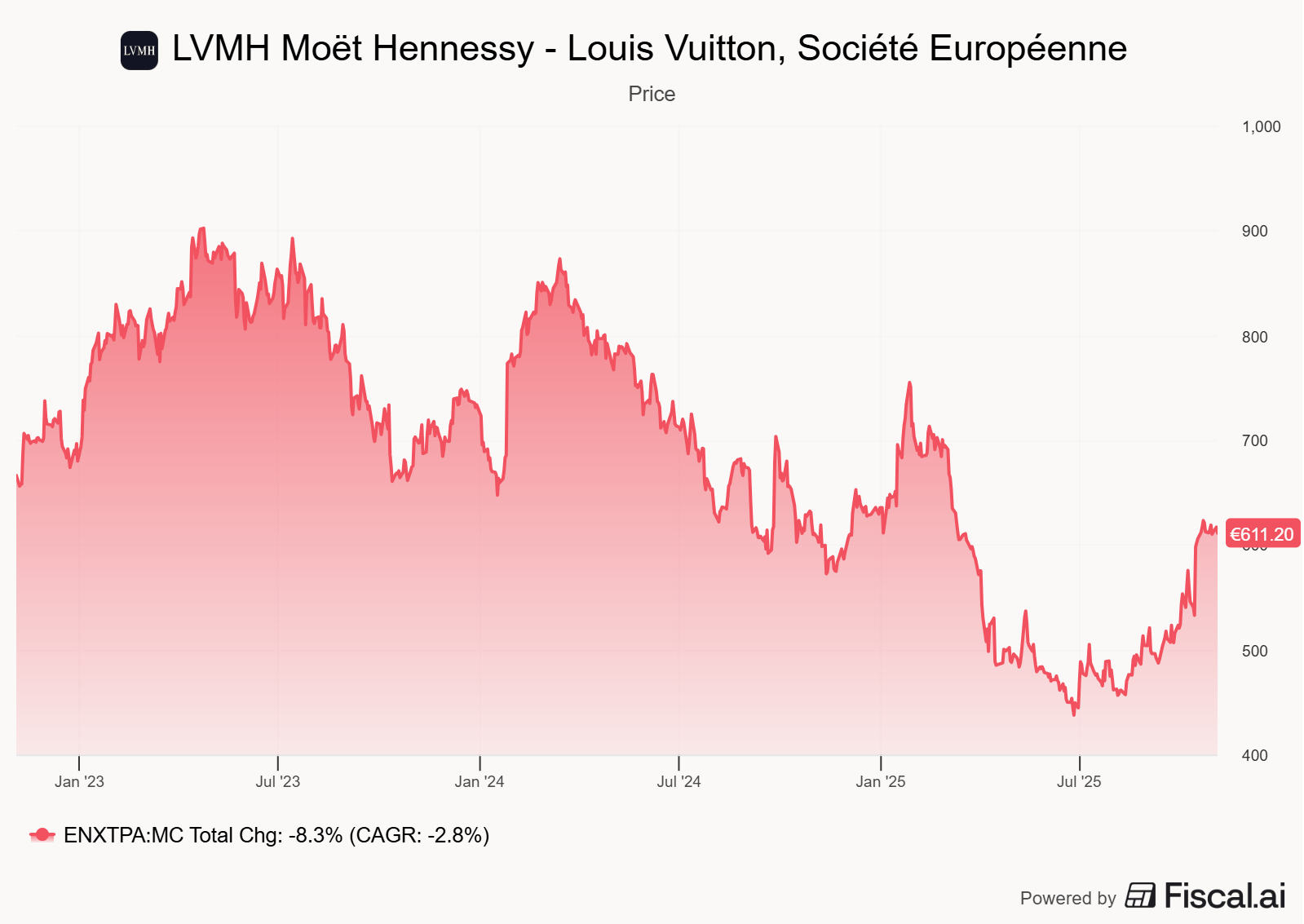

After years of aggressive price increases, LVMH now faces declining revenue as the pricing lever that powered growth through 2023 has been fully exploited—and the market has responded accordingly:

LVMH: 3-Year Stock Price Performance

Southwest Airlines

For 54 years, Southwest Airlines (LUV) never charged for checked bags.

Unlike their closest competitors (American Airlines, United Airlines, and Delta Air Lines), which collect $1-$1.5B annually in baggage fees, Southwest collected just $83M from overweight and third-bag fees in 2024.

Management estimated they could generate comparable revenues ($1B-$1.5B annually, or 3.6-5.5% of FY 2024 revenue) by charging, but feared losing $1.8B in market share. However, under pressure from activist investor Elliott Investment Management, Southwest implemented $35 (first bag) and $45 (second bag) fees on May 28, 2025.

Their Q3 2025 results and management commentary reveal what actually happened.

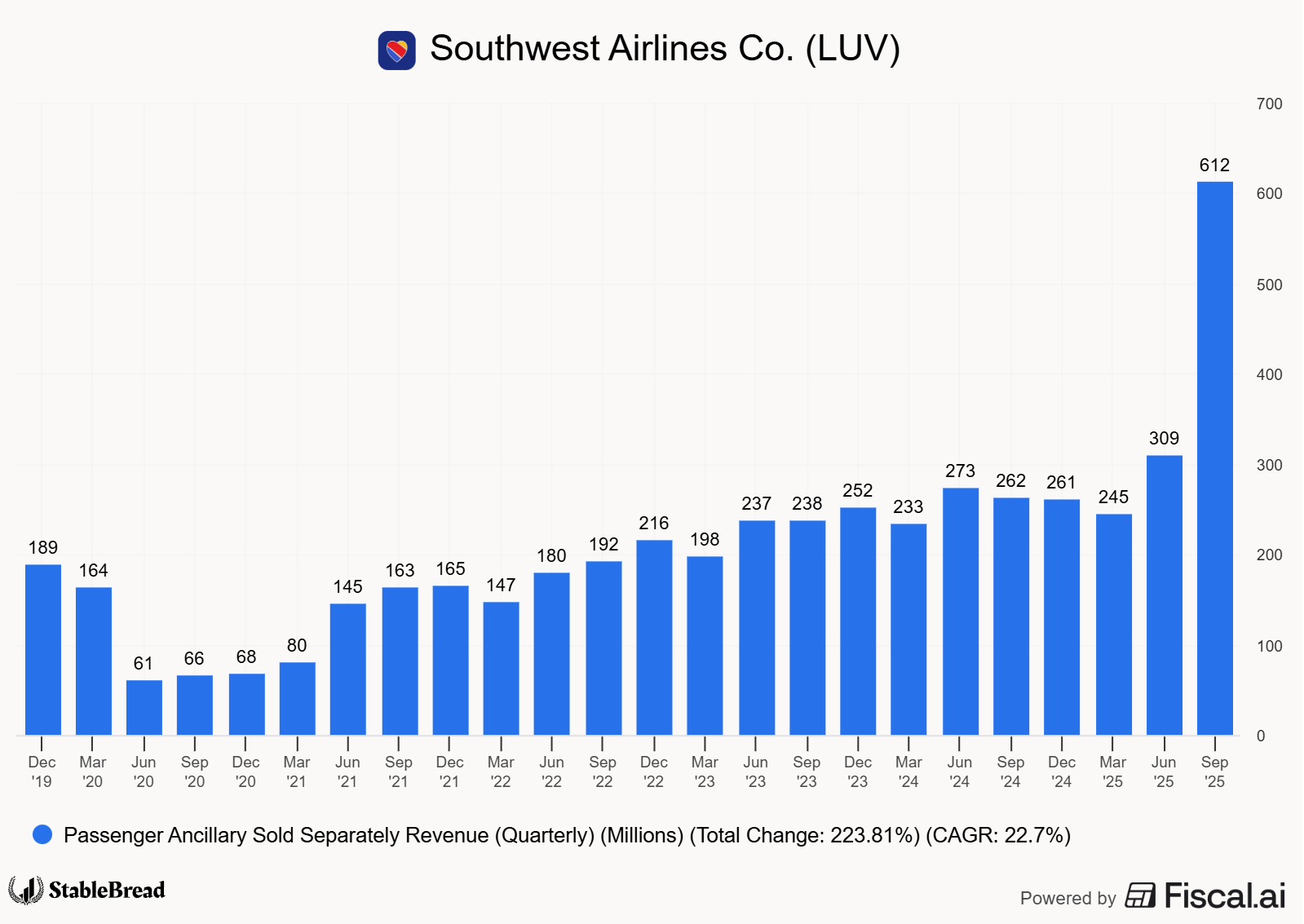

“Passenger Ancillary Sold Separately Revenue” jumped 133% from $262M in Q3 2024 to $612M in Q3 2025, driven primarily by the new bag fees:

LUV: Quarterly “Passenger Ancillary Sold Separately” Revenue Growth

Management confirmed on their Oct. 23, 2025 earnings call that Q3 bag fee revenue hit $300M, tracking toward the expected $1B annual contribution.

COO Andrew Watterson also noted on the Oct. 23 call that "our checked bag revenue per passenger is right along the same lines as the big three," suggesting customers haven’t stopped flying on Southwest due to this new change.

Currently, the additional revenue is offsetting the core business weakness (within other revenue segments) rather than driving growth. But if the business normalizes, the bag fees represent a margin improvement opportunity.

With operating margins of just ~1% in both FY 2023 and 2024, adding $1B+ in high-margin ancillary revenue (3.6-5.5% of total revenue) would move operating margins to ~4.6-6.5%.

If anything, this demonstrates that some pricing power can prevent margin deterioration even when implemented late.

Thanks for Reading!

StableBread Resources

Stock Analysis Checklist: This 50-question stock analysis checklist (direct download link) will help guide your stock research.

Spreadsheets: Login to the customer dashboard (with your email) to access 60+ Excel models.

Articles: Read 100+ in-depth guides on stock analysis, stock valuation, and portfolio management.

Newsletter Posts: Browse 40+ newsletter posts, where we share specific teachings from successful value investors.

Investors: Visual and list of 50+ investors who beat the S&P 500 Total Return Index over an extended period of time.

Calculators: Accelerate the stock analysis and valuation process with 150+ web-based calculators.